- Is Forex Trading Gambling Or Not Applicable

- Is Forex Trading Gambling Or Not Recognized

- Is Forex Trading Gambling Or Not Working

The world of Forex Trading is commonly misunderstood, with many unaware people who are not entirely sure what forex actually is, or stands for. If you are familiar with what forex is, then you may be surprised to hear that there are those out there who believe that forex is gambling!

So, is forex gambling? The short answer is NO, forex trading is not gambling, however, there are certain aspects of forex trading that may resemble gambling to some. It really comes down to the trader and how they are trading, predicting currency swings, and watching trends – if they are trading without proper estimation, then forex may very well be a gamble for them.

Why forex is not gambling is a statement that must be explored a bit more if you want to understand; in this post, I’ll go over some of the various ways that forex is gambling and why forex is not gambling.

Is Forex Trading Just Gambling?

Alright, to first delve into the question of forex trading vs gambling, let’s go over what forex trading actually is.

To understand whether or not Forex trading really is gambling or not, we need to understand the definition of gambling. So let’s take a look at 3 definitions of gambling by different sites. In Dictionary.com, gambling is defined as. You know if you asked a professional Forex trader to tell you if Forex is gambling, most of them will say it is not,they will cover it to be an investment or business.no doubt it is a business but it has every features of gambling.people say it is financial currency trading.the name Forex trading makes it look like no one is gambling in the market.it makes us believe that we are trading currency,when the price is about to go up, we will buy and when it is about falling down, we will sell but.

Here’s a summarized description of forex trading straight from the forex authority websites BabyPips and The Balance:

- Forex, short for foreign exchange, is a global market where currencies are traded with one another.

- It is the most heavily traded in the entire world (a volume of over 5 billion a day).

- The demands and economic status of different nation’s currencies result in varying levels of value.

- These shifts in currency prices are what forex traders try to profit off of.

Similar to the stock market, traders can spend and invest all the money they are capable of spending as they please. If they feel so inclined, they can dump capital blindly, without any type of analysis or thought process – sometimes they might get lucky, sometimes they won’t.

Obviously, this isn’t recommended.

For lots of traders who fail to properly assess and predict swings and trends in currencies, they are essentially gambling.

The definition of Gambling:

1)play games of chance for money, or

2)take risky action in the hope of a desired result

Considering the definition of gambling, is forex trading just gambling?

If gambling can mean taking risky actions with the hope of a certain outcome, forex can be considered gambling, depending on who is doing the trading.

Also, no matter how good you are at trading forex, there is a lot of risks involved; the markets are highly volatile, and most traders utilize leverage which can be dangerous.

If a person is uneducated on the forex markets and has no clue what they are doing, and are also placing trades with the hopes of making some coin, they are by definition gambling.

Many novice forex traders bring emotion and or feelings of luck into trading, which many people bring into gambling as well, which will not work.

However, gambling is not in the DNA of forex trading – most of us, especially the ones who are successful, are not gambling when we are trading forex.

Forex trading is a long game (at least it is for us professional/full-time traders), whereas gambling is not.

All you need to do is take the time to learn and implement the proper strategy in order to make it less of a hobby (or money pit) and more of a job.

Is Forex Trading Like Gambling?

Is forex gambling?

Not really.

Is forex trading like gambling?

Sure, maybe.

Forex trading can be like gambling in a lot of ways.

However, while I don’t know a lot about gambling, I’m pretty sure I can go as far as saying there isn’t much strategy involved.

So yes, while forex trading can be like gambling, forex trading involves strategy, analysis, and technique that most gambling does not require.

Forex Trading vs Gambling

Let’s examine the similarities and differences between forex trading and gambling.

Forex Trading vs Gambling: Similarities

- High risk involved

- Unpredictable or unexpected outcomes

- Sometimes leaving results to chance

- Occasionally lots of money involved

- Potential for great wins

Forex Trading vs Gambling: Differences

- Gambling is a game of chance

- Forex Trading is centered on financial market performance

- There is a learning curve for forex trading

- There is no learning curve in gambling

- Forex trading involves many technical tools that allow you to estimate outcomes

- Forex trading can be a full-time career

These are only some of the most basic similarites and differences of gambling vs forex – obviously, the lists are endless.

Is forex gambling?

This is the point is: forex is not gambling.

Why Forex Is Not Gambling

Those who are addicted to gambling typically have the belief that their next bet is the winner – this false optimism is what leads them into bankruptcy and debt, with them hoping that the next gamble will result in money and riches.

Unfortunately, forex trading can be the same – a lost trade is just as painful, and many traders will enter more positions in order to try and win back the money they just lost. This is a painful cycle that only results in money lost.

In both gambling and forex trading, a recent string of wins can inspire the trader/gambler with a false feeling of security – this only leads to more loss, as it is typical that recent wins or favorable positions have no effect on future trades or gambles.

The only way to ignore this false sense of security is to approach every position or game with the viewpoint of a loss – to understand that there is a chance that you may lose.

So, why is forex not gambling?

Forex is not gambling because there is a learning curve!

This is the main reason that separates forex from gambling. Not only can you learn forex trading and develop new strategies and approaches, the more you trade, the better you get.

Gambling is something else entirely – when you gamble, you are placing you money in the hands of chance.

While the forex markets can be unpredictable at times, they can be anticipated and you can get better at predicting how a certain currencies value will move.

Financial markets do not act out of change; they move and change due to a variety of factors, ranging from small-scale to national economic news, and these factors are events that forex traders have the benefit of analyzing.

To compare gambling to forex trading is an incredibly oversimplified comparison, and upon deeper inspection the differences between the two outweigh the similarities.

In other words, this is why forex is not gambling.

To become a successful trader is to learn and master your approach to trading currencies – as far as I know, there is no such thing as a successful gambler, or else it wouldn’t be ‘gambling’ at all.

Forex Trading Vs Sport Betting

Yep, if forex trading vs gambling isn’t enough, I’ve even seen people comparing forex trading vs sports betting.

While there are similarities between forex trading and gambling, there are even fewer similarities between forex trading and sports betting.

To be fair, they can be likened to one another in a couple ways – in both sports betting and forex trading, you are betting on an outcome in order to (hopefully) make profits.

With sports betting, you are predicting that one team wins over another, or something of the sort.

With forex trading, you are banking on shifts in market volatility that will make you money – the goal here is for the currency prices to change in relation to another so that you make profits off of these shifts in currency value.

Another similarity is that both forex trading and sports betting

The main difference between sports betting vs gambling is what determines the outcome.

In forex trading, shifts in values of currency pairs come from factors such as:

- supply and demand

- economic news

- national events

In sports betting, you are betting on people. Unfortunately, people do not act the same way markets do, and you really are leaving it up to chance – this isn’t to say that you can’t make educated estimations with sports betting, because you can, but when you are placing your money on how certain teams or people perform athletically against one another, this is mcuh different than putting money in the financial markets.

While sports betting can certainly be profitable, I can confidently say that forex trading is much more predictable and ‘learnable’ than sports betting is.

Final Words: Is Forex A Gamble?

Yep, forex trading can be a gamble.

Especially when it comes to short-term, the markets can act very random and it can seem as though to bet on them (or try and make any sort of profits from market changes) is an act of gambling.

However, when you look at the bigger picture, your odds of winning at forex trading is heavily based off of your skill and your skill alone.

You cannot ‘learn to gamble’, but you can learn to trade forex.

The better you get at forex trading, the less you will lose and the more money you will win.

And, just to throw it in there, the profits you can make just from trading forex can be substantial.

Learn to Trade Forex

If you are willing to put in the time that is required to become a good (or at least decent forex trader), then it can be a very lucrative career or side hustle.

Not to mention the benefits of trading forex as a full time job are endless as well, such as being your own boss, unlimited earning potential, set your own hours, etc.

For those who want to learn how forex works and how you can make profitable trades every single day, go read our Forex Mentor Pro Review – a mentorship program that will take you from beginner to pro forex trader ASAP.

Also, if you haven’t already, make sure to grab your Free Forex Trading Fortunes PDF – get a copy sent straight to your email below.

[convertkit form=1499651]Is Forex Gambling?

Forex trading can be a bit of a gamble if you aren’t assessing your trades properly, however the difference between forex and gambling is that with forex, you can learn and get better – gambling is only a game of chance.

I’m a full-time forex trader, happily making money from the comfort of my own home.

I help others find financial freedom and success with forex trading.

You probably have heard a little about Forex trading now and you’re interested to get into it.

However, you have a concern…

And the concern is whether Forex trading is gambling.

I get it.

Before I got into trading, I was interested to know whether it’s really possible to be profitable in Forex trading…

Or was it like playing against the casino knowing that I’ll NEVER win in the long run because the odds are against me?

So is Forex trading gambling, or is it legitimately a place where you can consistently earn an income from?

Let’s find out.

The Definition of Gambling

To understand whether or not Forex trading really is gambling or not, we need to understand the definition of gambling.

So let’s take a look at 3 definitions of gambling by different sites.

In Dictionary.com, gambling is defined as:

- the activity or practice of playing at a game of chance for money or other stakes.

- the act or practice of risking the loss of something important by taking a chance or acting recklessly:

In Wikipedia, gambling is defined as:

- the wagering of money or something of value (referred to as “the stakes”) on an event with an uncertain outcome, with the primary intent of winning money or material goods.

And in Encyclopedia Britannica, gambling is defined as:

- the betting or staking of something of value, with the consciousness of risk and hope of gain, on the outcome of a game, a contest, or an uncertain event whose result may be determined by chance or accident or have an unexpected result by reason of the bettor’s miscalculation.

So the common theme that these 3 sites are saying about gambling, is that it’s the act of wagering money on a game of chance or luck with an uncertain outcome.

So the question comes down to:

Is Forex trading really a game of luck, where you have no idea of your chance of winning?

Or is Forex trading a game of probability, where you can determine your chance of winning?

To understand this, let’s get into the most well-known place associated with gambling…

The Casino.

The Casino Gaming Model

Are casino games a game of luck or probability?

Let’s use the example of one of the most popular games in the casino – the Roulette.

The Roulette is a game where players bet on numbers on the roulette wheel and get a payout if the ball lands on their numbers.

There are different types of bet combinations on the numbers and different payouts.

If you bet on individual numbers, your payout is 1:35.

If you bet on either of the dozens, your payout is 1:2.

If you bet on red or black, 1st half or 2nd half, even or odd, your payout is 1:1.

For our purposes, we will use the red and black bets with the payout of 1:1.

That means if you bet $1, you will win $1.

In the European Roulette Wheel, there are a total of 37 numbers.

You can see on the wheel that there are red numbers, black numbers and one green “zero” on the wheel.

So let’s say we bet on black.

Many people think that this is a 50 percent chance of a win.

But is it really?

There are a total of 18 black numbers on the wheel.

So your odds of winning are:

18 black numbers / 37 total numbers = 48.65% (rounded up to nearest 2 decimal places)

So in actuality, you only have less than a 50% chance of winning each time.

Now you might be thinking:

“But Davis, this is close enough to 50%. What difference does it make?”

Well, my friend, this makes ALL the difference in the long run.

You see, while you may get lucky and win a few games and even walk out of the casino a winner…

But it doesn’t mean you will win in the long run.

That’s because it’s already been decided the moment you play the game that you will lose in the long run as the odds are against you.

For example, if you flip a fair coin, it will be a 50-50 chance of it landing in either heads or tails.

But if you flip the coin 5 times, it’s possible to get head all 5 times.

However, if you flip the coin 10,000 times, chances are that the probability will normalize and you’d get close to 5,000 heads and 5,000 tails.

Here’s a chart of a test done where a fair coin was flipped 32 times and was done over 50,000 runs.

You can see on the chart that the more times the runs were done, the number of heads gotten was 16 out of 32 times (which represents a 50% probability).

That means the more times the coin was flipped, the more the outcome normalized to the actual probability of the coin what was 50% to either get heads or tails.

Now, let’s get into the mathematics to show you your exact outcome when you’re betting on the roulette wheel.

For this, we use an expectancy formula.

This is to determine how much you win or lose on average for each time you bet.

If it’s a positive expectancy, it means on average you are winning a certain amount each time you bet.

If it’s a negative expectancy, it means on average you are losing a certain amount each time you bet.

The expectancy formula is as follow:

(Percentage Win x Average Amount Won) – (Percentage Lose x Average Amount Lost)

So assuming you’re betting $100 each time on the either red or black, your expectancy is:

(48.65% x $100) – (51.35% x $100) = – $2.70

This is a negative expectancy.

What this means is that on average, each time you bet $100 on red or black, you’re in effect losing $2.70.

Now, if you play just 10 times, you could leave the casino a winner.

But just like the chart shown on the outcome of coin flips, the more times you play the roulette wheel, the more the actual probability will play out.

And that means you WILL eventually lose your money.

How much?

Well, if you bet 100 times on red or black, then you’re expected to lose $2.70 x 100 times = $270.

In fact, if you didn’t know, all the casino games are designed for you to lose over the long run.

But the players going to the casino somehow think they can beat the casino.

In my opinion, that’s the real definition of gambling – playing in a game that has the odds against you but thinking you can win.

Is The Casino Gambling?

So here’s a very interesting question for you to consider…

Since the casino is in the category of “gambling”, is the casino also considered gambling against their patrons?

Back in the 1980s, there was a group of MIT students that went to the casino to play Blackjack and was said to have walked away with millions of dollars.

There’s even a movie called 21 that’s all about this group of MIT students.

This group of MIT students used a method of card counting to have an edge over the casino in Blackjack.

That means they used a method that has rigged the odds in their favor so they will win over the long run.

This method was developed by a man named Edward Thorp.

He is a mathematician and even released a book about it called Beat The Dealer.

After that incident, the casino started to blacklist these people and anyone who is suspected of “card counting”.

Now if the casino was in the game of gambling, why didn’t they continue to allow the MIT students to play at their tables?

That’s because the casino knows that they WILL lose in the long run.

The MIT students have found a way to “beat” the casino.

It’s no longer a game of chance or luck.

It’s now a guaranteed winning game for the card counters and a losing game for the casino.

You see, the casino isn’t in the game of gambling.

They are running a business.

That means they have to ensure that they are profitable in the long run.

And the people who are contributing to their profitability are their patrons.

Hence, when they realize that the card counters had “rigged” the blackjack game in their favor, they had to stop them.

Many casinos now even implemented changes to their Blackjack tables…

Particularly using automated card shufflers to make card counting practically useless.

So here’s the truth…

While the players at the casino are gambling, the casino isn’t.

That’s because they have already rigged the games in their favor so they know they will in the long run.

They know that in the long run over hundreds of thousands of bets, the probability will eventually play out to their favor.

This is their Edge.

That’s also the reason why the casino is open 24 hours and there’s no clock in the casino.

They even serve food, drinks, provide entertainment in the casino, and even give you free accommodation at their hotels if you gamble big enough.

They want you to stay there for as long as possible until their probabilities play out and you run out of money.

Redefining Gambling

So now that we understand that the casino, in reality, is not gambling because they know they will win in the long run…

We have to redefine what gambling is and how it relates to Forex trading.

So here’s my take on the actual meaning of the word “gambling”…

Is Forex Trading Gambling Or Not Applicable

In my opinion, gambling is when you have absolutely no idea about the probability of you winning over the long run…

Or, you know that the odds are against you but you somehow hope that you can still be profitable.

In other words, you are depending 100% on luck to become profitable.

On the other hand, if you know the probability of you being profitable in the long run with statistics to back it up, then you’re not gambling.

You don’t rely on luck to win, but on your probability to play out in the long run, just like the casino business.

How To Be The Casino In Forex Trading

When you’re playing in the casino, you have no choice but to play the games according to their rules.

But that’s different in the Forex Market because there are essentially are no rules.

You can trade however you want, whenever you want, and the market won’t chase you away just because you’re winning.

But, of course, you can’t expect to win the game of Forex trading by randomly entering and exiting trades.

So the question now becomes:

“How do you rig the Forex trading game in your favor and treat it as a business like a casino?”

The answer…

By putting the odds in your favor with two things:

- Positive Expectancy

- Positive Swaps

Positive Expectancy

Positive Expectancy is when you know on average how much your trading system will make per trade.

I’ve already gone through the expectancy formula earlier, but we’ll now dive into using it for trading.

To calculate this, you would need to know your trading system’s win/loss ratio and the average profit per win, and the average amount you lose per loss.

To get this data, you will have to test your trading system across many trades.

Generally, the bigger the number of trades, the more accurate the data will be.

But for a start, 100 trades would be able to give you a good idea of your trading system’s expectancy.

Once you have the data, you can calculate your expectancy using this formula:

(Win Percentage x Average Profit Per Trade) – (Loss Percentage x Average Loss Per Trade)

So if your win/loss ratio is 50-50, the average profit per trade is $100, and the average loss per trade is $50, then your expectancy will be:

(50% x $100) – (50% x $50) = $25

What this means is that you expect to make an average of $25 per trade.

So if you want to make $2500 for the month, then you would need to have 100 trades.

Is Forex Trading Gambling Or Not Recognized

Positive Swaps

The other way to put the odds in your favor is through Positive Swaps.

Swaps are the interest rate differential between two currencies.

So if you are Long EURUSD, it means you are buying the Euro and selling the US Dollar.

And by doing so, there is an interest rate differential between these two currencies.

So when you hold a trade overnight, you are either paid a Positive Swap or you have to pay a Negative Swap.

And this depends on the currency pair and the direction of the trade you’re taking (i.e. Long or Short).

When you have both a Positive Expectancy trading system and Positive Swaps, you are putting the odds in your favor.

And because of this, you’ve rigged the Forex trading game to your advantage.

All you have to do then is to have good risk management, and let your probability play out over lots of trade to become profitable in the long run.

Conclusion

So after everything said here, is Forex trading really gambling?

Yes and no.

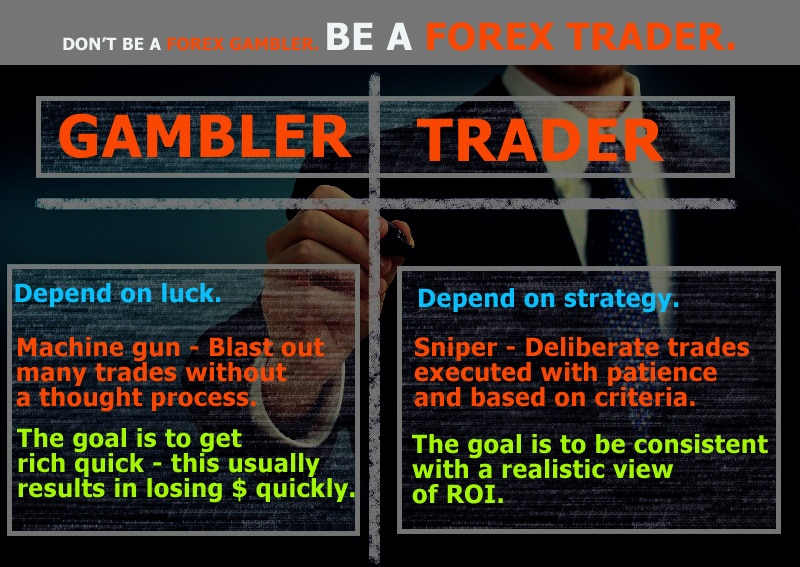

It’s gambling when you…

- Have no trading strategy or system, and you enter trades based on gut feeling…

- Don’t know what your win/loss ratio and trading system’s expectancy is…

- Are relying on luck to be profitable in the long run.

But it’s not gambling when you…

- Have a firm trading system in place with clear rules for your entries and exits…

- Tested your trading system over a large number of trades which resulted in a positive expectancy…

- Have good risk management and let your positive expectancy play out over the long run.

So whether Forex trading is gambling or not ultimately comes down to you.

Do you treat Forex trading like going to the casino and trade based on luck?

Or do you treat Forex trading like a business and trade with the expectancy of coming out profitable in the long run?

You get to decide.

One more thing…

Did you like this post?

If you liked this post or felt it was helpful for you, would you please share it?

Remember, sharing is caring, and it won’t even take 5 seconds of your time.

Is Forex Trading Gambling Or Not Working

So go ahead, click the share button below now to help more traders get an Edge trading the Forex market